Exploring the net Gold Market: A Complete Guide to Obtainable Options

Lately, the web gold market has undergone important transformation, making it simpler than ever for consumers to purchase, promote, and invest in gold. With the rise of e-commerce and developments in expertise, a plethora of choices are actually out there for those trying to purchase gold on-line. This text delves into the present landscape of on-line gold sales, highlighting the varied sorts of gold merchandise available, the platforms by which they are often bought, and necessary considerations for consumers.

Kinds of Gold Merchandise Obtainable On-line

The online gold market presents a various range of merchandise catering to totally different funding methods and personal preferences. Listed here are some of the commonest types of gold obtainable on the market on-line:

- Gold Bullion: Gold bullion refers to bodily gold within the form of bars or coins that is valued based mostly on its weight and purity. Gold bars are available in numerous sizes, from small 1-ounce bars to larger 1-kilogram and even 400-ounce bars. Gold coins, such because the American Gold Eagle or the Canadian Gold Maple Leaf, are also in style amongst buyers. Bullion is usually offered by weight and is a favored selection for these looking to invest in gold as a hedge towards inflation.

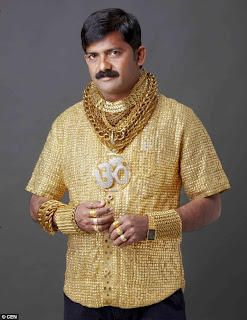

- Gold Jewellery: While primarily seen as a luxurious merchandise, gold jewelry may also be an investment. On-line retailers supply a wide choice of gold jewelry, together with rings, necklaces, bracelets, and earrings. When buying gold jewelry, patrons ought to consider the purity of the gold (measured in karats) and the craftsmanship concerned, as these elements can significantly affect the value.

- Gold ETFs (Change-Traded Funds): For those looking to invest in gold without the hassle of bodily storage, gold ETFs present a superb possibility. These funds are traded on stock exchanges and monitor the price of gold, permitting investors to buy shares that signify a selected quantity of gold. Online brokerage platforms make it easy to invest in gold ETFs, offering a convenient way to gain publicity to the gold market.

- Gold Mining Stocks: Another oblique method to invest in gold is through gold mining stocks. These are shares in corporations that mine for gold. The performance of these stocks is commonly correlated with the price of gold, making them a viable choice for investors trying to capitalize on rising gold costs. Many online buying and selling platforms offer access to a variety of mining stocks.

- Gold Certificates: Some on-line platforms supply gold certificates that characterize possession of a specific quantity of gold saved in a secure location. This selection allows buyers to personal gold without having to bodily retailer it. Gold certificates is usually a handy and secure way to invest in gold.

Where to Buy Gold Online

With the rising reputation of online gold gross sales, numerous platforms have emerged, every with its personal unique offerings. Listed here are some of the most reputable choices for buying gold on-line:

- Dedicated Treasured Metals Sellers: Websites like APMEX, JM Bullion, and Kitco concentrate on precious metals and supply a wide collection of gold merchandise. These dealers present detailed data in regards to the merchandise, together with pricing, availability, and delivery options. They usually have user-friendly interfaces that make it easy to navigate their inventory.

- On-line Marketplaces: Platforms like eBay and Amazon additionally characteristic listings for gold merchandise. Whereas these marketplaces can provide competitive prices, buyers ought to exercise warning and conduct thorough analysis on sellers to ensure authenticity and reliability.

- On-line Brokerage Companies: For those keen on gold ETFs or mining stocks, on-line brokerage companies corresponding to Charles Schwab, Fidelity, and Robinhood present access to quite a lot of investment options. These platforms typically provide analysis tools and assets to help investors make informed choices.

- Native Coin Shops with Online Presence: Many local coin outlets have adapted to the digital age by establishing online shops. This gives a chance to support small businesses while buying gold. Patrons can often discover unique items and personalised service via these shops.

Vital Considerations When Buying Gold Online

Whereas the comfort of purchasing gold on-line is undeniable, there are several vital components to contemplate to ensure a protected and passable shopping for expertise:

- Authenticity and Purity: All the time verify the authenticity and purity of the gold you’re buying. Reputable dealers will present certification and documentation proving the purity of their products. Look for gold that’s at the very least 99.5% pure, which is the usual for investment-grade gold.

- Pricing: Gold costs fluctuate based on market conditions. When buying on-line, examine prices from multiple sources to ensure you’re getting a fair deal. If you have any questions regarding in which in addition to the way to work with buynetgold, you can call us from our web site. Remember of premiums added to the spot worth of gold, as these can vary considerably between dealers.

- Transport and Insurance: Consider the transport options and insurance insurance policies supplied by the vendor. Secure shipping strategies and insurance coverage protection can protect your funding during transit. Review the return coverage as properly, in case it’s worthwhile to return the product for any purpose.

- Fame of the seller: Analysis the reputation of the net vendor earlier than making a purchase order. Look for buyer evaluations, rankings, and any complaints filed against the seller. Trusted dealers will often have a strong online presence and constructive suggestions from earlier customers.

- Storage Options: In case you select to buy physical gold, consider how you will store it. Protected storage is essential to guard your investment. Options include residence safes, safety deposit containers at banks, or professional storage companies supplied by some dealers.

Conclusion

The net gold market has opened up new avenues for buyers and collectors alike, offering a wide array of gold products and purchasing options. From bullion and jewelry to ETFs and mining stocks, the choices are plentiful. Nonetheless, potential patrons must stay vigilant, conducting thorough research and contemplating key factors equivalent to authenticity, pricing, and seller fame. By doing so, they will navigate the web gold market successfully and make knowledgeable decisions that align with their investment goals. Because the market continues to evolve, the accessibility of gold is probably going to increase, further solidifying its place as a useful asset in the world of finance.